november 2021 child tax credit date

These updated FAQs were released to the public in Fact. How Next Years Credit Could Be Different.

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit.

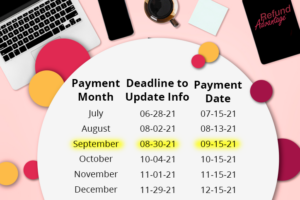

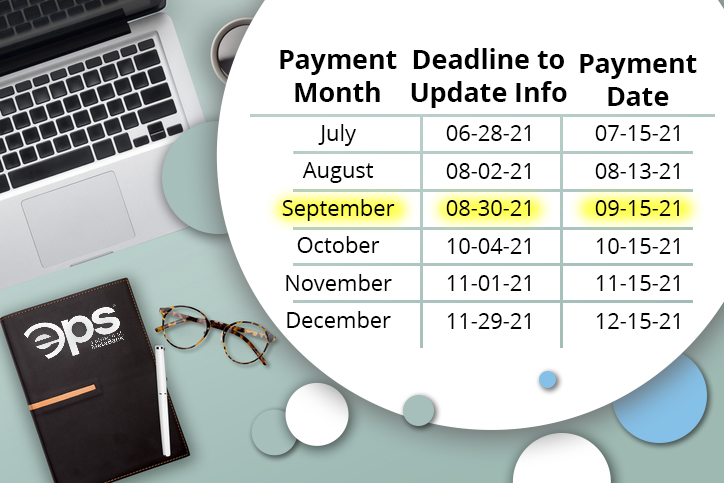

. Department of the Treasury November 16 2021. 13 opt out by Aug. 15 opt out by Aug.

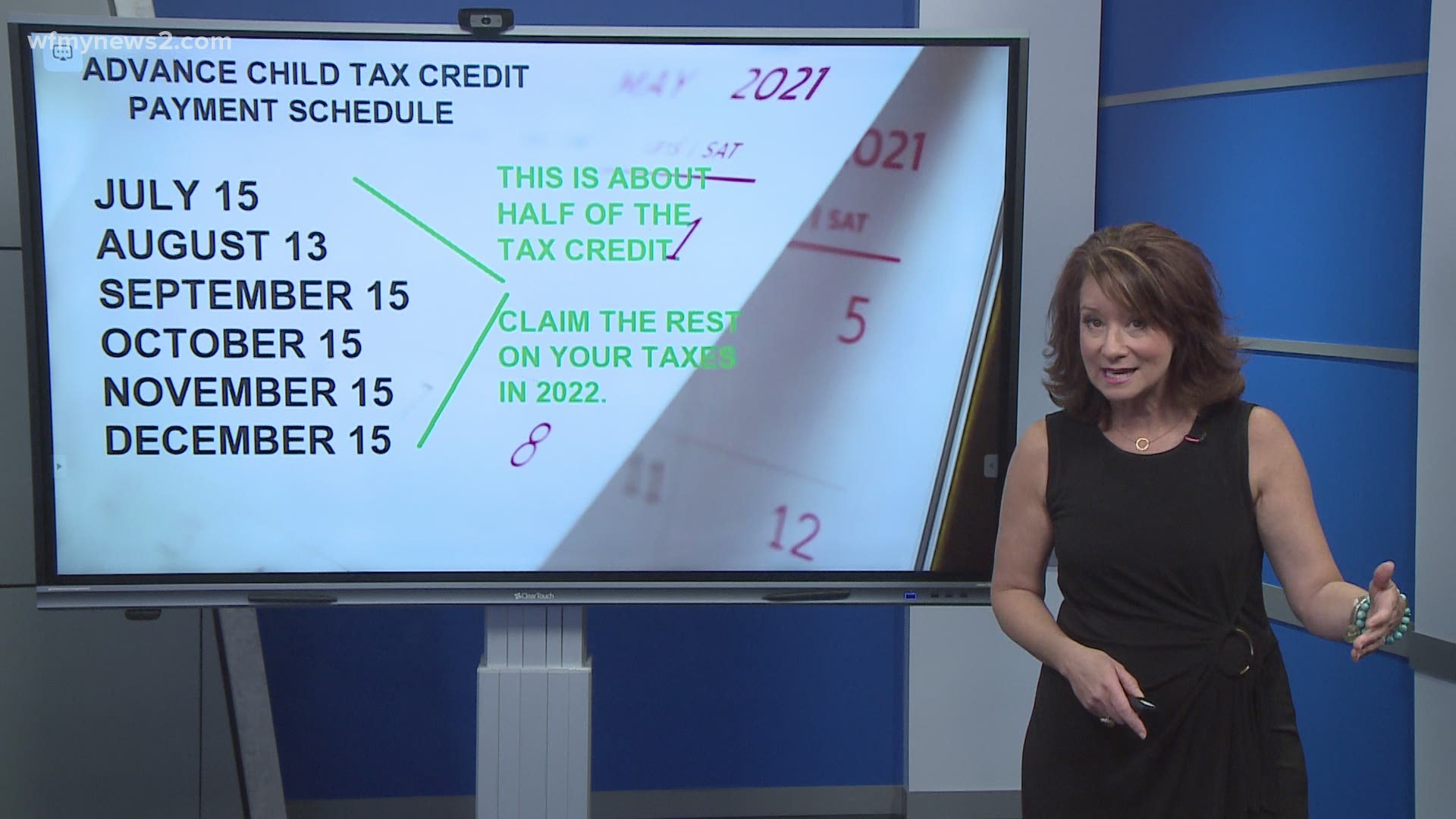

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. The fully refundable tax credit which is. 12 2021 Published 1036 am.

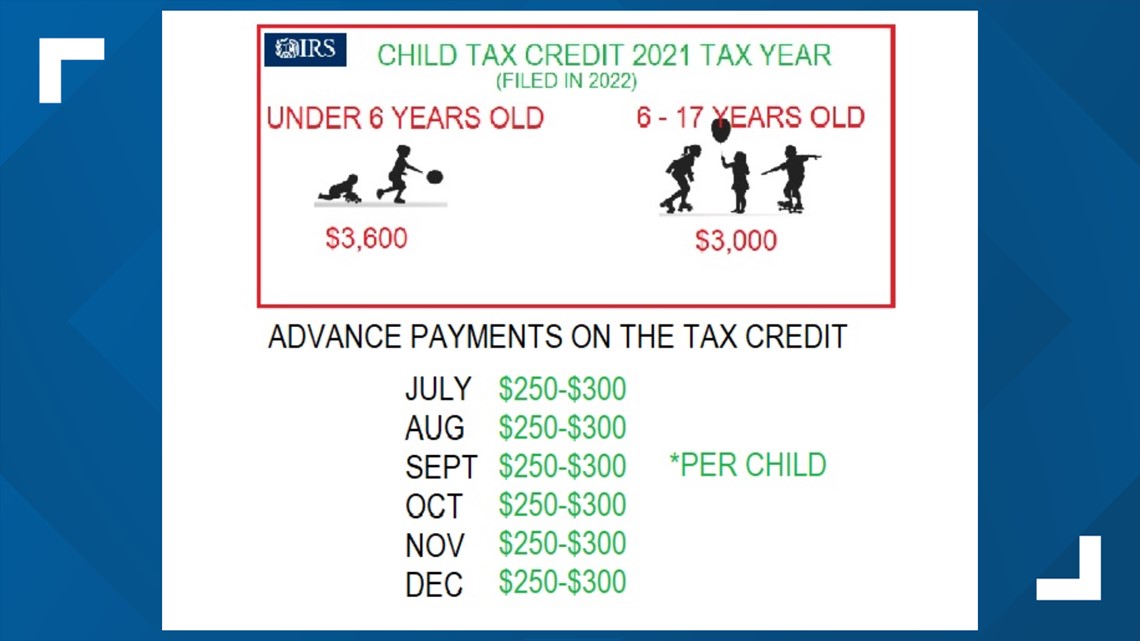

This years expanded Child Tax Credit allotted 3600 per child age five and under in all eligible families and 3000 per child ages six to 17. 15 is also the date the next. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of.

658 PM EDT November 5 2021. Child tax credit deadline coming that could give up to 1800 per child to some families on Dec. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

6WDWH 7RWDO 1XPEHU RI 3DPHQWV V. The total child tax credit for 2021 itself amounts to up to 3600 per child ages 5 and younger and up to 3000 for each qualifying child age 6 through 17. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit.

Advance Child Tax Credit Payments Distributed in. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to. In 2021 more than 36 million American families may be eligible to receive a child tax credit.

If you select direct deposit your money will be paid out on that date. The payments were split up. This measure was to coax the vote of Senator Joe Manchin a.

Frequently asked questions about the Advance Child Tax Credit Payments in 2021 Topic A. The Child Tax Credit was to be expanded for five years until 2025 but now the end of 2022 will be the deadline. Alberta child and family benefit ACFB All payment dates.

The IRS has confirmed that theyll soon allow. TIGTA reviewed 1789 million of. Child Tax Credit 2022.

IR-2021-222 November 12 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their. Wait 10 working days from the payment date to contact us. W ith Novembers payment now out the IRS is down to one payment left this year coming in DecemberAnd while for many the checks and direct deposits have arrived on time each.

Distributed in November 2021. The IRS will soon allow claimants to adjust their.

The Impacts Of The Child Tax Credit Now And In The Future Kentucky Youth Advocates

What Is The Child Tax Credit Tax Policy Center

Padden Cooper Cpa S Remember That The Child Tax Credit Is Optional If You Request It Now You Cannot Claim It Later On Your Taxes For More Help Call 609 953 1400 Childtaxcredits Taxes

Tax Tip 2021 Advance Child Tax Credit Information For U S Territory Residents Tas

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Elm3 S Guide To The 2021 Child Tax Credit Tax Accountant Financial Planner

Child Tax Credit 2021 Update November Stimulus Check Payment Date Is Next Week Ahead Of Final 300 Deadline The Us Sun

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

The Irs Sends Monthly Payments To Parents Starting In July Wfmynews2 Com

Last Day To Unenroll In July Advanced Child Tax Credit Payment

Childctc The Child Tax Credit The White House

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com

4 News Now Q A What Should Parents Know About The New Child Tax Credit Kxly

Discover Child Tax Credit Eligible S Popular Videos Tiktok

Refund Advantage A Division Of Metabank Child Tax Credit Calculator Help Families Understand Actc

Child Tax Credit United States Wikipedia

Child Tax Credit Payment Schedule For 2021 Kiplinger

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities

Eps Powered By Pathward The Child Tax Credit Payments Pros And Cons To Think About